The UK Government has delivered its first Spending Review since 2021, setting firm departmental spending limits through the end of the decade and sharpening the fiscal outlook for devolved administrations—Scotland included.

Covering day-to-day (resource) spending through 2028–29 and capital (investment) spending to 2029–30, the review provides a long-overdue map of how Westminster plans to allocate public funds in a constrained economic environment.

While no seismic changes were unveiled, the Spending Review formalizes key trends that will directly influence Scotland’s block grant via the Barnett Formula—especially in light of the UK Government’s renewed focus on fiscal discipline and value for money.

Zero-Based Budgeting and a New Debt Rule

Labelled a “zero-based” review, this Spending Review marks a departure from incremental budgeting. Instead of rolling over previous spending patterns, the UK Treasury reassessed all departmental commitments from scratch—a move not undertaken in nearly two decades.

That philosophical shift could spell tighter scrutiny for all areas of public spending, including those that feed into Scotland’s devolved budget.

Two core fiscal rules—first announced by Labour in opposition and now adopted by the UK Government—frame this new approach:

-

All resource (day-to-day) spending must be funded by revenues, not borrowing.

-

Public debt must fall as a share of GDP by 2029–30.

This means the UK Government will only borrow to fund capital investment, and even that is now more tightly monitored.

However, a technical shift in how public debt is measured could unlock as much as £53 billion in additional capital investment space, according to analysis by the Institute for Fiscal Studies (IFS). That change, though not directly earmarked for Scotland, could result in a larger capital block grant via the Barnett formula—depending on departmental allocations.

Key UK-Level Commitments Affecting Scotland

Beyond the framework itself, several recent UK Government policy decisions will have indirect but material implications for Scottish public finances.

The most significant of these is the Strategic Defence Review, published on 2 June. It pledges to raise defence and intelligence spending to 2.6% of GDP by 2027, with an ambition to reach 3% in the next Parliament, subject to “fiscal and economic conditions.”

While defence is a reserved matter, higher spending in this area—particularly if channelled through capital departments—could boost Scotland’s funding share through formula consequences. But it also risks crowding out spending in devolved-relevant departments like health, education, or justice.

Fiscal Headroom vs Budget Pressure

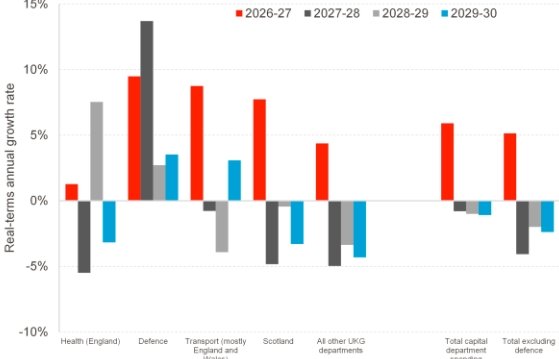

Despite the headline-grabbing figure of £53 billion in potential new investment space, analysts warn that the overall tone of the review remains cautious. Real-terms growth in departmental budgets is expected to be subdued, especially in non-priority areas.

For Scotland, this likely means:

-

Modest year-on-year increases in resource funding—though not enough to undo recent pressures on the NHS, local government, or social care.

-

Flat or shrinking per capita capital allocations, unless defence or infrastructure departments receive major uplifts.

-

An increasingly constrained fiscal environment for the Scottish Government, which cannot borrow for day-to-day spending under current devolution arrangements.

Implications for the Scottish Budget Process

The Spending Review clarifies the likely UK departmental comparators that will determine Scotland’s future block grants. The 2025–26 Scottish Budget, due later this year, will now be framed within these newly published UK totals.

Importantly, the resource rule—requiring tax revenues to fully fund day-to-day spending—may limit the UK’s ability to top up public services, placing indirect pressure on the Scottish Government to find its own savings or revenue streams.

In capital terms, the potential £53bn investment window could offer opportunities—if directed into infrastructure departments that trigger Barnett consequentials. But that’s still subject to ministerial decisions in London.

Political Reaction Likely to Follow

Initial responses from Holyrood are expected once the Scottish Government has fully digested the departmental allocations. The Scottish Fiscal Commission, Audit Scotland, and the Fraser of Allander Institute are all expected to issue technical commentaries over the coming days.

It also sets the stage for what could become a contentious pre-election budget cycle. If Labour forms the next UK government, it would inherit these spending plans but may seek to revise or rebalance them in line with its own policy platform—especially around public service investment.

At a Glance: Key Points from the 2025 Spending Review

| Item | Details |

|---|---|

| Review period (resource spending) | Up to 2028–29 |

| Review period (capital spending) | Up to 2029–30 |

| Budgeting approach | Zero-based (first time in 18 years) |

| Fiscal Rule 1 | Resource spending must be funded by revenue (no borrowing) |

| Fiscal Rule 2 | Public debt must fall relative to GDP by 2029–30 |

| Defence Spending Ambition | 2.6% of GDP by 2027; 3% next Parliament (if fiscal space allows) |

| Capital investment potential | Up to £53bn additional headroom via new debt measurement method |

| Scottish Budget impact | Dependent on UK departmental allocations triggering Barnett consequentials |