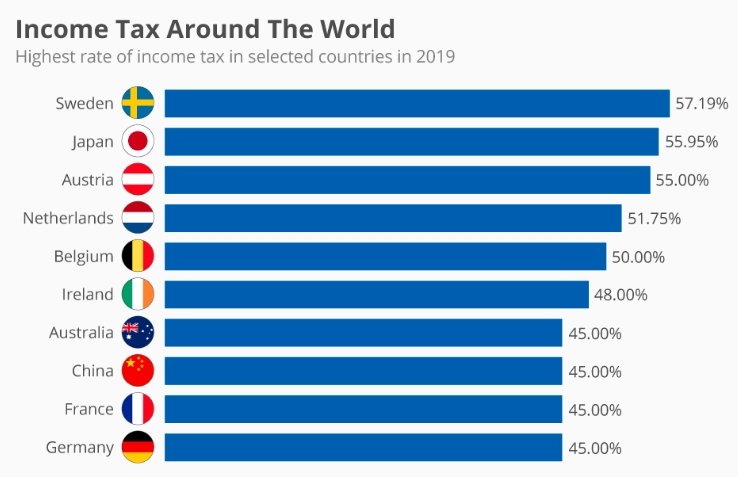

As countries roll out their tax reforms for 2025, it’s interesting to see how India’s income tax rates stack up against those of other developed nations. With debates around tax fairness and the economic impact of such rates heating up, here’s a look at the highest tax rates on personal income around the globe.

US vs. India: Comparing Tax Brackets

In the United States, the federal tax system is progressive, with the maximum rate of 37% levied on earnings above $609,000 (around ₹5.3 crore). The rates vary depending on income, with lower earners paying significantly less. For instance, those with earnings up to $58,000 pay just 22%, providing a stark contrast to the hefty 37% for those at the top.

On the other hand, India applies a flat 30% tax rate to its highest earners, but things get trickier when considering additional surcharges. These surcharges can go as high as 25% for taxpayers under the new regime or 37% for those filing under the old tax structure, bumping the tax rate up to a combined total of 39% or 42.7%, respectively. Adding a 4% cess to this makes the effective tax rate even more substantial.

Scotland’s Strikingly High Income Tax Rates

In the UK, the tax rates range from 0% to 45%, but things are different in Scotland. Scottish residents face a higher maximum tax rate than the rest of the UK, with the top rate of 48% on income over £125,140 (approximately ₹1.37 crore). This steep rate applies to individuals earning above that threshold, making Scotland one of the higher-tax jurisdictions in Europe.

For comparison:

- Those earning between £75,000 and £125,000 are taxed at 45%.

- The rate starts at 19% for income over £12,571 and climbs progressively.

Australia: A Close Rival to the UK

Australia isn’t far behind, with a maximum tax rate of 45% for individuals earning over $190,000 (about ₹1.02 crore). However, Australia imposes an additional 2% Medicare levy on these earnings, bringing the total effective rate to 45.9%. This makes Australia’s tax system relatively comparable to the UK’s, especially in terms of the maximum rates imposed on high earners.

Here’s a quick summary of the highest tax rates across various countries:

| Country | Maximum Tax Rate | Income Threshold |

|---|---|---|

| United States | 37% | $609,000 (₹5.3 crore) |

| United Kingdom | 45% | £125,000 |

| Scotland | 48% | £125,140 (₹1.37 crore) |

| Australia | 45% + 2% Medicare Levy | $190,000 (₹1.02 crore) |

The Global Trend of Progressive Taxation

Tax rates are often used as tools to influence the economy and income redistribution. High rates on the wealthy, like those in Scotland, the US, and Australia, are justified by governments as necessary for funding public services. While high taxes on top earners may seem burdensome to some, they are seen as a way to ensure that wealthier individuals contribute more to public services like healthcare, education, and infrastructure.

In India, the government’s approach is similar, with a strong emphasis on redistributing wealth through various tax structures. The Budget 2025 update, which slashes the surcharge on high-income earners, seems to strike a balance, making the tax burden slightly less daunting but still progressive enough to fund essential services.